Before fintechs transformed the payment landscape, sending money abroad required a physical trip to the bank – or navigating a frustrating online portal – a barrage of paperwork, and detailed justifications.

Transactions then trudged through the SWIFT network’s antiquated framework, slowed by intermediary banks, and took days before reaching their destination. Errors like incorrect codes were a nightmare to resolve, with no real-time tracking offering clarity. And when funds finally cleared, murky exchange rates and hefty fees would have carved a chunk of the original amount.

This inefficiency is in stark contrast to the seamless, tech-driven and customer-centric solutions on offer today. Still, the evolution of fund transfers started at a crawl and then exploded.

In the space of two decades, the outdated traditional money transfer system, rooted in Mesopotamia and ancient Greece, was flipped on its head.

Through proprietary systems optimised for speed, fintechs operating in the international money transfer space have leveraged advanced technology and automation to deliver a superior customer experience. These disruptors have reshaped cross-border transactions, outpacing traditional banks with innovative, user-friendly solutions that prioritise speed, transparency, and convenience.

Of dots and dashes

The high-tech world of digital fiat transfers and new digital currencies originated in the Second Industrial Revolution, a period of explosive innovation that reshaped communication and finance.

In 1871, Western Union, which started 20 years previously as a telegraph company, launched a money transfer service allowing rapid cross-border payments across the US, also known as electronic funds transfers (EFTs).

This marked a shift from merchant-focused transfers to services accessible by ordinary consumers.

Fast, then slow

Since 1973, banks have dominated under the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system.

SWIFT was a leap forward in wiring funds because it standardised communication and transaction processes between banks globally, replacing the patchwork of manual methods marked by inconsistencies and delays.

By providing a secure, uniform protocol for interbank messaging, SWIFT enabled banks to process cross-border payments more reliably. However, this dominance came with significant drawbacks. The SWIFT network tethered international transfers to a slow and costly infrastructure, reliant on intermediary banks to relay funds from sender to recipient, tacking on unpredictable fees and inflating costs.

As digital demands grew, SWIFT’s inefficiencies became striking, setting the stage for fintechs to come up with better alternatives.

New thinking

Technology is at the heart of this evolution. PayPal laid the groundwork with its global digital platform in the late 1990s: first by focussing on domestic peer-to-peer payments, then expanding its offering to enable clients in multiple countries to send and receive money across borders via a digital wallet. Xoom honed in on smaller cross-border transfers, Wise refined the model with transparency and efficiency, while Revolut expanded the scope with multi-currency accounts and instant, app-driven exchanges.

Personal touch

Where many banks still lean on manual compliance checks and paper trails, fintechs automate their processes, reducing human intervention and errors, thereby streamlining the process with digital precision, explains Harry Scherzer, CEO of South African international money transfer fintech Future Forex.

“Some use algorithms to handle routing and documentation seamlessly; others also have dedicated account managers to provide personalised support and boost efficiency. The result? Cross-border transfers that are not only faster, but also cheaper and more accessible, breaking down traditional barriers in the international payments space,” Scherzer explains.

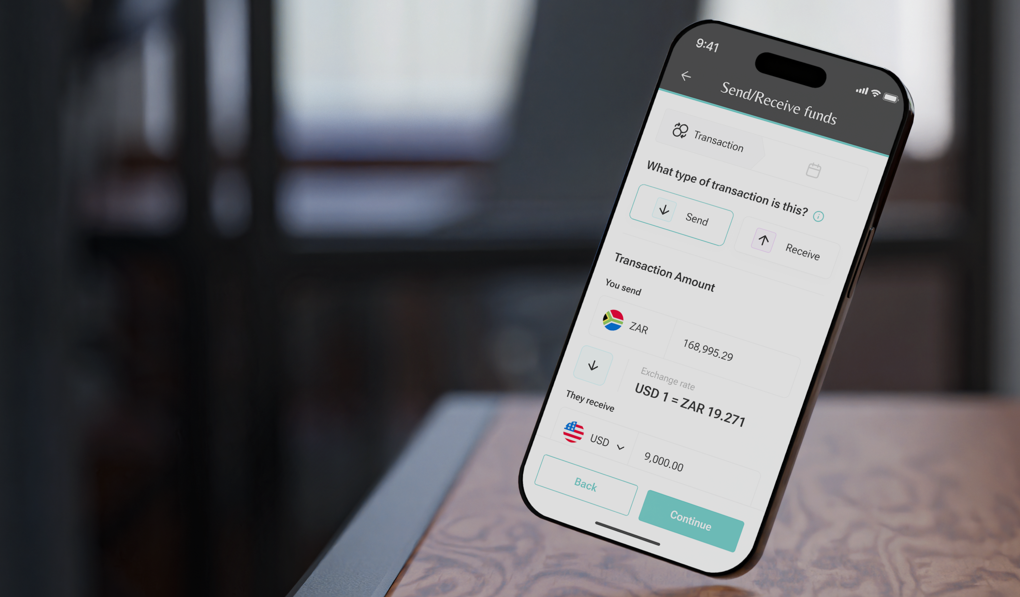

Customer experience, however, is fundamental. Apps must be sleek, intuitive, and packed with features. Scherzer says real-time tracking allows users to monitor transfers and exchange rates instantly, but maintaining the personal touch is key.

“A hybrid approach of blending tech with personal service builds trust and simplifies compliance. This focus on usability and transparency turns a once-dreaded task into a frictionless experience, enhancing control and clarity for customers.

Fintechs have transformed cross-border transactions by challenging banks head-on, spotlighting the inefficiencies of legacy systems and replacing them with a faster, customer-centric model. They’ve torched the old playbook, delivering swift, transparent, and seamless international money transfers.